2025

Introducing Media Radar & Global Leaders Feed: Real-Time, NLP-Powered Market-Moving Insights

On Monday, we’re launching our Global Leaders Feed — a real-time stream of social and news announcements from influential U.S. cabinet members and global leaders. Why? Because they move markets.💥 Case in point:- Today at 1:18 pm ET (17:18 GMT), President Trump posted on Truth Social that reciprocal tariffs would “PAUSE.”- Within minutes, the U.S. stock market rallied in one of its largest 30-minute moves in history (see image).🔍 And yet — CNBC and other outlets couldn't identify the reason for the surge until after the bulk of the move had already happened. ⚠️ Earlier the same day, China’s retaliatory 84% tariffs were posted on Reddit and X/Twitter — a full 6 minutes before traditional financial media and 9 minutes before a low-latency Reuters ALERT.📰📉📈 Markets Are Moving Faster Than the News 📡 Introducing Media Radar:A real-time NLP-powered feed that extracts early signals from high-impact media platforms. Our feed delivers structured JSON metadata, ready to plug into quant models, signal engines, alerting systems, and portfolio risk tools. NLP Tags Provided:🔹 Entities: 20+ types (stocks, commodities, currencies...)🔹 Topics: 1,000+ (accounting, litigation, tariffs...)🔹 Events: 4,000+ (dividends-payment, factory-build...)🔹 Sentiment: Finance, ESG, commodity scores🔹 Emotions: 14 dimensions (anger, fear, optimism...)For a sample of the Global Leaders feed or a trial of Media Radar:👉 Reach out to: support@marketpsychdata.com👉 Or sign up here: https://lnkd.in/gtUPfc_B

April 09, 2025

Behavioral Finance Phenomenon: The Stock Market’s Turnaround Tuesday

📉 Get Ready for Turnaround Tuesday in the Stock Market 📈 On Monday, September 15th, 2008, I was in the green room for a financial news segment, preparing to speak on behavioral finance. A CEO of a large equity investment firm was also there. As he left, he turned to me and said: “Get ready for Turnaround Tuesday!” 📊 That Tuesday turned out to be one of the biggest rallies in S&P 500 history.Curious, I looked into it further — and sure enough, the stock market has a quirky history of rallying on Tuesdays following steep Monday selloffs. It’s a known behavioral phenomenon.

April 07, 2025

How Tariff Talk Has Evolved in US Earnings Calls Over the Past 23 Years

We analyzed mentions of "tariffs" in U.S. earnings calls over the past two decades:🔹 In 23 years of data, only the Trump presidencies saw tariffs become a major boardroom topic. 🔹 During Trump I, it took time for tariff talk to ramp up. 🔹 In Trump II, we've surpassed the prior peak — and the bulk of earnings season hasn't even hit. 🔹 Mentions are now far beyond the previous peak. 👀 Market participants are clearly bracing for geopolitical and trade turbulence. 💬 This time the Trade War does not look like a negotiation tactic.

April 07, 2025

Stocks Tied to Tariff Talk Are Tanking

Stocks Associated with Tariffs are Tanking We collected all U.S. earnings call transcripts from March 2025 and grouped companies into three buckets: 1️⃣ No mention of tariffs 2️⃣ Mentions tariffs 3️⃣ Mentions tariffs 30+ times in a single earnings conference call Then we looked at April stock returns… 👀 The results speak for themselves:🔵 Companies that didn’t mention tariffs had better average performance🔵 Those that talked tariffs saw worse returns🔵 And frequent tariff talkers? Down over 16% on average.

April 07, 2025

Falling US Stock Index Sentiment is Now Approaching 2022 Lows

An update on our Feb 25th post - falling sentiment often pulls the stock market lower in a predictable fashion, especially when sentiment is dropping from a high level. US stock market sentiment is now approaching 2022 lows, but not COVID lows. Uncertainty and fear are also rising significantly. When those two emotions stabilize, prices could rebound in a "relief rally." But we've got a ways to go before that can happen.

April 03, 2025

Companies Most Affected by Tariffs in the Past 24 Hours

In the past 24 hours, the companies most positively and negatively associated with "tariffs" in the media. In the image, the horizontal bars represent the average sentiment of co-mentions of the company with "tariffs" in the past 24 hours of media coverage. At least 5 co-references required to be plotted. 👍 Possible beneficiaries (or less-affected) companies include:1. BJ's Wholesale Club - inventory is largely tariff-resistant2. Philip Morris - consumers want their staples (like tobacco) regardless of price.3. Goodyear - competitors are much more affected, so Goodyear will benefit.4. Ferarri - customers are price insensitive.5. First Solar - like Goodyear, the company will benefit from high tariffs on low-cost Chinese competitors. 👎 Among losers, shipper Maersk is sinking (sorry), Best Buy's almost entirely non-US electronics stock is becoming costlier, and Puma's "cheap" shoes are no longer so.

April 03, 2025

Webinar: Accelerate Alpha with LSEG & MarketPsych

If you're interested in the power of earnings calls over markets, please join our upcoming webinar on April 2nd at 3pm UK Time / 10 am ET: https://lnkd.in/gMqN-kr2

March 31, 2025

Sentiment of Companies Associated with Tariffs: 95% Were Negative

In the past 3 months of earnings calls we averaged the sentiment of every sentence in which an analyst referenced "tariffs." Exactly 100 companies had more than 3 such tariffs references. On average, only 5% of companies were positive, while 95% were negative. The level of positivity was anemic for those five positive companies and was exceptionally negative for the remaining ninety-five. Please join our webinar April 2nd (https://lnkd.in/gy3TjFf9) or reach out for more info about the newly launched LSEG MarketPsych Transcript Analytics.

March 31, 2025

Rebellion Research Quant Event at Columbia University

Greatly enjoyed another fantastic quant event hosted by the finance rockstar Alexander Fleiss of Rebellion Research at Columbia University. So lucky to be on a panel moderated by the maestra Christina Qi with Didier Rodrigues Lopes Petros Zerfos Chris White and Yosef Zweibach. We discussed the applications of AI models in modern investment, what AI tech is building viable value-creating products, and much more. Looking forward to the next one!

March 21, 2025

How a Single Trump Social Media Post Creates or Destroys Billions in Value

The information that is moving markets is changing - now a single Truth Social post by Trump creates or destroys tens of billions in value. See the minute bars for Solana (SOL) below move after Trump's Truth Social post on the U.S. crypto reserve. Contact us for access to the market moving data you need in real-time.

March 17, 2025

Declining Sentiment on Tesla Signals a Price Slide

Is souring sentiment on Elon Musk driving Tesla shares lower? As we noted in a post over a week ago, declining sentiment on the US stock market indicated a price slide was likely (it happened). A similar effect seems to be hitting Tesla shares. Let us know if you'd like to see our whitepaper on how media sentiment can predict "risk-off" regimes, especially when sentiment falls from high levels.

March 11, 2025

US Stock Index Sentiment Drops Over the Past Week: Further Downside Expected?

Overall US stock index sentiment dropping fast over the past week. Sentiment downturns from high levels usually lead to further downside in markets (sentiment Granger-causes price momentum). Ask for our whitepaper.

February 25, 2025

Trump's Social Media Messages' Effects on Global Markets

Trump is moving global markets through his Social Media messages, in the below example, Crude Oil dropped up to 3% based on his messages about ending the Ukraine War. Let us know if you'd like more information about our low-latency news and social media data feeds.

February 13, 2025

MarketPsych Data on WRDS - Social sentiment on meme stocks, crypto, and more

We're excited to announce that the MarketPsych Data WRDS Edition for both financial and ESG themes and sentiments are now available for research here on WRDS.The dataset is unparalleled in its global news and social media coverage. It uniquely provide sentiment, emotion, and thematic scores for every financial asset including real estate, interest rates, and cryptocurrencies. A point-in-time ESG data set is also available.SUMMARY: MarketPsych WRDS Edition (MWE) includes Buzz and Sentiment scores - derived from thousands of global news and social media sources dating back to 1998 - for dozens of topics across more than 42 sectors and industries, 275 equity indices, 170 currencies, 3,000 locations, 130,000 companies, 112 commodities, and 600 cryptocurrencies. The ESG version includes ESG Buzz and Sentiment scores for dozens of ESG topics across 130,000 companies and 250 countries and territories. Data is published separately for news and social media. MarketPsych's data is used by researchers and quants in over 25 countries. MarketPsych's data has been extensively researched in academic and industry studies and has appeared in over 300 academic papers in top finance journals, including the Journal of Finance, Energy Economics, Journal of Portfolio Management, and the Journal of Financial Economics.Please visit us on WRDS or respond to this email if you'd like more information or sample data. And please note, MarketPsych's data is also available via the London Stock Exchange Group (LSEG)).Best wishesThe MarketPsych Data Team

February 10, 2025

Positive Sentiment Ranking of Companies Benefitting from Easing Tariff Concerns

Another week of Tariff discussion, with several companies on the positive side of sentiment due to relief of Tariff fears. The image shows companies associated with tariffs ranked from most to least positive over the past week, according to news and social media. Note Amazon is being said to evade the worst of tariff pain. Nucor is a U.S. steelmaker likely to benefit from 25% tariffs on non-US steel. Whaleco (Temu) got a reprieve from Trump's proposal to tax packages from China.

February 10, 2025

Ranking of Companies Most Affected by Tariffs Negatively

Companies ranked by the negativity of tariffs for their businesses, summarized from the past 7-days of media about these companies. The lowest ranked is Constellation Brands, who imports alcoholic beverages into the automotive companies occupy most of the bottom 10. There is concern about tariff blowback onto Palantir and Nvidia. METHODOLOGY: Sentences with more than 30 co-occurrences of a company name and synonyms of "Tariffs" (import taxes, etc...) in a single sentence were selected from the past 7 days. The average sentiment of those sentences was calculated and is represented in the length of the blue bar in the image below, where a longer bar indicates more negative sentiment.

February 03, 2025

Sentiment Ranking of Publicly-traded Companies Associated with DeepSeek AI

Publicly-traded companies associated with DeepSeek AI ranked from most positive to most negative portrayals by the media. On the positive side, Apple could use cheap AI in it's phones and AMD's chips can be used to create DeepSeek-like models. On the negative side, ASML (excellent AI without their extreme Ultraviolet), Oracle (just announced billions of investment in the unnecessary(?) StarGate), and Broadcom (designing for NVDA). Contact us to learn more about the power of real-time NLP for discerning market trends.

January 27, 2025

Most Positive Industry in 2024: Nanotechnology

Nanotechnology is 2025's most positively-discussed industry in global business media. In 2024 Robotics was top, and it is ranked third for 2025. See image below for the 2025 rankings and the top publicly-traded nanotech companies (ranked by mention count, not by quality - DYOD).

January 17, 2025

2024

New Research on Greenwashing Detection Combining Slow vs. Fast-moving ESG Scores

New paper on greenwashing detection by combining Slow (filings-based) vs Fast-moving (media-based) ESG scores. Blog post with paper link here: Slow and fast ESG scores: what do they tell us? Thanks to the diligent research efforts of Svetlana Borovkova and Probability & Partners. Data provided by LSEG Data & Analytics.

November 30, 2024

Ranking of Companies Based on the Average Tariff-associated Sentiment

We assessed the sentiment of all companies mentioned in media referencing tariffs in the past 3 days. We ranked the companies by their average Tariff-associated sentiment and plotted them below. A minimum of five (5) references in the past 3 days was necessary to be on this list.

There are a few surprises - some from the EV space below:1. BYD is positive because it is such a low-cost producer that even with high tariffs its cars will be relatively inexpensive in the U.S.2. Tesla is negative because of the retaliatory tariffs that China is likely to impose in any trade war, hurting Tesla's ability to sell in China plus raising the cost of cars produced at its Shanghai factory.3. Rivian is negative because its cars are already relatively expensive in the U.S. and it has a China-based supply chain, which will lead to even higher costs.

November 09, 2024

Media Sentiment Ranking of Companies Associated with Trump's Victory

The media is declaring some companies winners and losers following Trump's victory. Below are companies associated with Trump's victory and ranked by media sentiment over the past 24 hours. Note Tesla (Elon Musk) and Palantir (Peter Thiel) are most positive while Meta (Mark Zuckerberg) is most negative.________The methodology behind this study:1. Identify all companies mentioned in the same sentence with "Trump".2. Sentences were selected from 1,000+ global business and investment news and social media sources and published in the past 24 hours. 3. All companies must have been associated with Trump in the same sentence at least 50 times.4. Average the sentiment of each sentence.5. Plot them from most to least positive sentiment in a bar chart (below).

November 07, 2024

US Election 2024: Sentiment vs. Attention – What Truly Decides the Outcome?

In business media, Kamala has been associated with more positivity (positive sentiment) in the sentences that discuss her versus the sentences associated with Trump. But importantly, the volume of conversation (attention) heavily favors Trump.

So what will determine the US election outcome - sentiment or attention?

November 05, 2024

Sentiment Ranking of Companies Associated with AI Chips and GPUs

We searched our tools for the publicly-traded companies associated with "AI chips" and "GPUs", and we sorted them by media sentiment, with the most positive at the top. ASM International was the most positive over the past 90-days.

Of course, Nvidia was the most mentioned overall, but its average sentiment, although positive, did not qualify for the list.

As noted in our prior posts (and research), positive media sentiment has historically tended to lead prices higher.

October 01, 2024

Is the Trend Still Your Friend?

Dear Readers,

Today we open with one of the earliest observations of human behavior in financial markets. More than 400 years ago Josef De La Vega identified a behavioral pattern in his advice to individual investors.

“As there are so many people who cannot wait to follow the prevailing trend of opinion, I am not surprised that a small group becomes an army. [Most people] think only of doing what the others do and of following their examples. . . .” — Josef de la Vega, 1688, “Confusion de Confusiones” (the first book describing a stock market: the Amsterdam Exchange)

October 01, 2024

Effect of Volkswagen's Planned Factory Closure on Sentiment and Share Price

The image shows how VW's share price reacted after announcing their first planned closure of a German factory.

In our research we've identified a consistent 1-2 day negative return for stocks following a surprising negative news release. This average negative return is still true for both small and large stocks, including constituents of major global indices. Report coming soon.

September 10, 2024

Sentiment Shift Regarding the US Economy's "Soft Landing" Possibility

Sentiment about a "soft landing" for the U.S. economy has turned from positive ("yes, soft landing is happening") to negative ("we're going into a recession") over the past few days.

In the chart below the blue columns are the daily count of mentions of "soft landing" in the global business media. The blue line represents the daily average sentiment for the sentences where "soft landing" appears.

The soft landing sentiment flipped negative on Tuesday, Sep 3, 2024 after the ISM showed a continuing mild manufacturing contraction through August. When the narrative shifted, the equity markets started to sell-off.

September 06, 2024

The Performance of Companies Mentioning "AI" on Earnings Calls

How did companies mentioning AI in their Earnings Calls perform over the past 5 years? LSEG's Haykaz Aramyan, PhD and our own Tiago Quevedo Teodoro created a thematic portfolio using our new Transcripts Analytics. See the report here: https://lnkd.in/eNdbDpdZ

August 05, 2024

Companies Benefiting and Suffering from the CrowdStrike Outage

Companies affected by the CrowdStrike outage ranked by their outage-associated sentiment in business media.

Amazon, Zscaler, and FedEx look to benefit (note their positive associated sentiment), while Telstra, Delta Airlines, Tesla, and American Airlines are hit hardest by the software glitch.

July 19, 2024

Bitcoin’s Sudden Drop Preceded by a Decline in Social Sentiment

Bitcoin's sudden drop was preceded by a fall in social sentiment. While there may be a short-term bounce, sentiment still hasn't completely shaken out the weak hodl'ers.

July 08, 2024

Changing Trends in Apple’s Products and Services Mentions During Earnings Calls

The LSEG MarketPsych Transcripts Analytics offers insightful perspectives into the focal points of a company. The accompanying graph, developed by our colleague Elliot Chung, illustrates this by detailing the proportion of mentions that various Apple products and services received during Apple's earnings calls. This is measured as a fraction of the total mentions of all products and services. In the early 2000s, the Mac accounted for nearly 50% of these references. However, post-2007, the iPhone emerged as the predominant topic of discussion. At its peak, the iPad nearly matched the iPhone in terms of mentions, though it has since seen a decline in focus. Although the VisionPro represents one of Apple's most significant recent launches, it is currently referenced only about as frequently as the AirPods and the Apple Watch. Finally, there is a long-term trend in the overall increase in references to services (such as Apple TV, AppleCare, iCloud, etc.)

July 03, 2024

Companies Associated with NVIDIA in the Media

Which companies are likely to benefit from Nvidia's incredible revenue surge?

By scanning global news and social media over the past 30-days, we found the companies with the highest percent of co-references to the topic "Nvidia" in each sentence. In the image below, the company name is to the left and the blue bar length represents the percentage of sentences containing the company name that also contain the proper noun "Nvidia".

1. Dell supplies server hardware2. OpenAI (private) runs on Nvidia's H100 GPUs.3. Nvidia Corp is the legal entity4. Global Mofy is a declining penny stock being linked with Nvidia in social media (caveat emptor).5. Foxconn's stock rallied alongside Samsung and HK Hynix after Nvidia's blowout earnings last week.6. Astera makes components used in Nvidia GPUs.7. NetApp is partnered with Nvidia and provides software tools to manage data across Nvidia infrastructure....and many more (see image below)

May 27, 2024

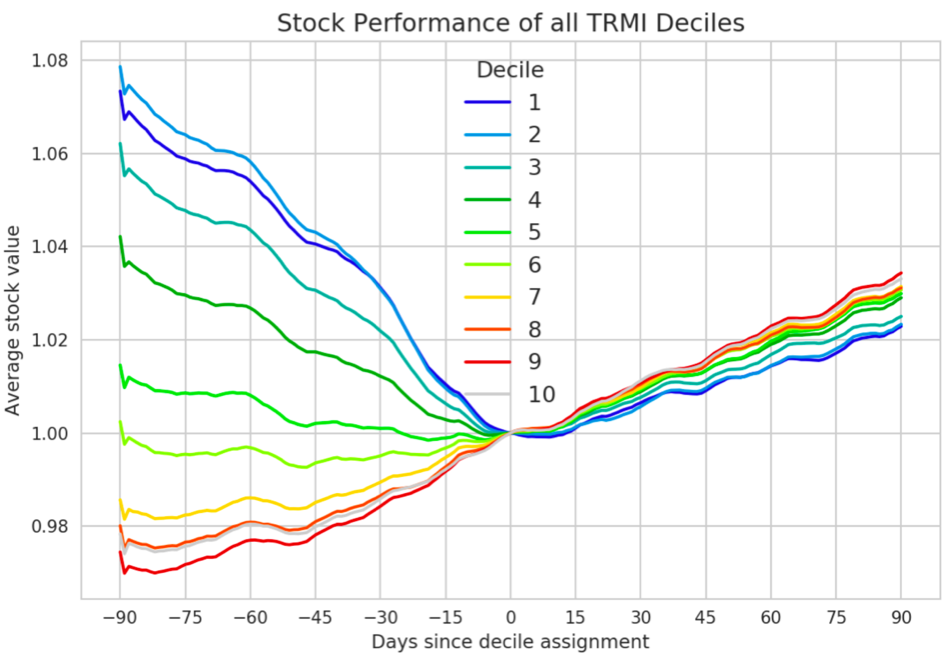

Earnings Conference Call Sentiment Systematically Impacts Share Prices

Stock prices of companies with the most positive earnings conference call hashtag#sentiment outperform over the following month. Below is a monthly updated example using past 90-day deciles.

• UNIVERSE: All US companies with available transcript data• REBALANCING: Monthly at the close of the last trading day• LOOKBACK: 3 months (usually last available quarterly call)

Note the stocks are bought at the beginning of the month, up to 90 days after the earnings conference call. The price drift is quite significant and long-term.

May 20, 2024

This is the Most Positive Earnings Season Since 2002 (according to earnings call sentiment)

Better-than-expected results have appeared more frequently than not in this earnings season. LSEG (London Stock Exchange Group) Workspace data shows that about 56% of companies have beaten the mean estimate. Such strong performances have been reflected in the earnings conference calls. In the plot below, we compare the average financial sentiment (from the LSEG MarketPsych Transcript Analytics) of all available earnings calls in the quarter until today with that of the same period in previous years. This is looking to be the most positive sentiment earnings season since the start of the data in 2002. Year to date, the FTSE All-World Index is up 8%, which is above average for the same period in previous years, although not abnormally higher.

May 16, 2024

U.S. Earnings Call Sentiment Reaches a 20-year High

Over the past 20 years corporate sentiment on earning scalls has been increasing (blue line) alongside stock prices (Russell 2000, IWV, black line).

Our research on quantile performance indicates that highly positive sentiment calls precedes stock price hashtag#outperformance (a post on that effect coming soon).

But why is higher call sentiment occurring? Could it be that consistently improving corporate fundamentals are reflected in more positive call sentiment? Are analysts becoming more polite (or maybe only the friendliest are selected to ask questions)? Or is it a result of executive communication coaching to avoid gaffes and add more positive polish? Or maybe all of the above…

May 15, 2024

How High CEO Optimism Drives Stock Outperformance

Public US-based companies led by highly optimistic CEOs have outperformed their peers over the last two decades. Our preliminary analysis, using the LSEG (London Stock Exchange Group) MarketPsych Transcripts Analytics data feed, reveals that companies helmed by the top 5% of CEOs, in terms of optimism levels during Earnings Calls, exceeded their peers' future stock performance by an average of 0.5% per month. The optimism metric in the data feed is one of 13 emotional dimensions evaluated in each sentence of the earnings calls. It utilises an LLM-based architecture designed to assess the probability of speakers conveying specific emotions.

May 15, 2024

In Earnings Calls: Top 10 Most Optimistic U.S. CEOs

The LSEG MarketPsych Transcripts Analytics offers detailed sentiment analysis on corporate communications, including quarterly earnings calls. It analyses each sentence to produce insights on topics, sentiment levels, and the probability of several emotions, including optimism.

Our initial studies using this data suggest a positive correlation between CEO optimism during earnings calls and relative stock price performance in the following months. With hundreds of earnings calls for Q1 2024 already underway, we present a partial rank of the top 10 CEOs from Russell 3000 companies based on their optimism during the current earnings season. As of now, Mr. Olivier Le Peuch, CEO & Director of Schlumberger, has had the most optimistic discourse.

While Optimism is depicted in the underlying blue bars, the superimposed black bars depict the financial sentiment level of these CEOs. The optimism is higher than sentiment for every CEO. Notable disparities between the optimism and sentiment levels, such as those observed in the case of Ms. Joanna Geraghty, CEO & Director of JetBlue Airways, could also serve as valuable features for future stock price modelling.

May 08, 2024

Optimism on Full Self-driving Near Historical Peak

"And I think it might be the biggest asset value appreciation in history when that day happens when you can do unsupervised full self-driving."~Elon Musk on Tesla's earnings call yesterday.

The optimism on full self-driving is near its historical peak, as depicted in the image below.

The image shows the average sentiment sentences referencing "FSD", "self driving" and "self-driving" (red line) in Tesla's earnings calls since 2019. Tesla's stock price is in black.

April 29, 2024

Expectations of Interest Rate Moves Drive Mid-term Stock Performance

Interest Rate expectations drive U.S. stocks in an inverse relationship (rates up => stocks down). As Warren Buffett famously said, "Interest rates are to asset prices … like gravity is to the apple."

Expectations often drive financial behavior. Since the monthly CPI came in above expectations last week, some economists are now expecting the Fed to raise before they lower rates in 2024-2025.

The chart below shows the rally in the Russell 1000 (top 1000 US stocks) since Oct 2023 as expectations for rates fell. The blue shading was placed between a 90-day and a 200-day average of interest rate forecasts derived from natural language processing (NLP) on thousands of news and social media sources discussing U.S. interest rates (sentiment analysis).

Note the stock rally was inversely correlated with rates expectations since October. As the narrative shifts and forecasts for rates move higher, we could see more air coming out of stocks until more assuring CPI numbers come in.

April 22, 2024

Bitcoin Sentiment Ahead of Halving

The overall media sentiment about bitcoin is in the high end of its range. According to academic research on social media and daily asset prices, "Sentiment predicts positive next-day returns, but attention predicts negative next-day returns." https://lnkd.in/g8GgXdHX. We see a similar effect at monthly and longer horizons for many assets (stocks, currencies, etc...). News media attention to bitcoin lately has been very high.

The Bitcoin Halving is likely to occur in late April. From a psychological perspective, the increasing scarcity of bitcoin increases its attractiveness. Yet the last halving was May 11, 2020, and previously one occurred in July 2016. Before and after the past halvings, there was no clear price impact of the events.

I've noticed in recent conversations at finance events that the launch of ETFs (specifically the SEC approval) has legitimized Bitcoin in the eyes of conservative financial institutions and family offices. Many are discussing new bitcoin products and investments. Surprisingly to me, the tradfi adoption of bitcoin as a store of value seems to be in early stages.

So is Bitcoin peaking? What does the halving mean? It's hard to know in the short term: sentiment is higher (and vulnerable to a fall). The high overall attention implies downward pressure in future months. Longer term (years) the momentum is still positive.

April 10, 2024

Largest Cryptocurrencies Sentiment Heatmap: March 2024

Historically social media sentiment about individual cryptocurrencies tends to drive their prices higher. The highest sentiment large coins in March 2024 so far are #DOT #ARBITRUM #MATIC #AVAX #BNB.

March 13, 2024

Top Small Cryptocurrencies by Sentiment

Here's a ranked view on some of the smaller #cryptocurrencies' sentiment from #socialmedia covering the period March 1 through March 12, 2024.

March 13, 2024

Our Media-based Stock Prediction Model, Continued Outperformance

We built a 30-day U.S. stock predictive model based on Media Sentiment using a simple Machine Learning algorithm - updated returns in the below image. Humans, even in hyper-competitive environments like the US stock market, respond predictably to news and social media content.The model was put in production in Aug 2019 and launched commercially on Jan 2020 in partnership with the StarMine team at LSEG Data & Analytics.The model ranks stocks (1 to 100) based on their likelihood of outperformance using a ML algo applied to only our LSEG MarketPsych Analytics news and social media-derived data. The blue line in the chart below depicts the spread between the top-ranked decile (10%) of stocks and the bottom-ranked decile - the absolute return portfolio. The gray-shaded regions are the 2-year training periods.The model performs similarly regardless of market cap. It is orthogonal to other StarMine models. It has about 30% monthly turnover, with no transaction costs assumed. Longer term models also work well with media data (we've tested out to 3 year forecasts).

March 12, 2024

Post Office Ltd and Fujitsu Scandal: Impact on ESG Scores

For our UK readers, the evolving scandal at the UK's Post Office Ltd & Fujitsu is rapidly impacting Fujitsu's ESG scores.

Background: The digital accounting system that the postmasters (regular people) entered their daily sales & cost calculations into were being fraudulently altered via remote access from the UK's Post Office Ltd / Fujitsu.

In our ESG data Post Office Ltd has the lowest (1st percentile) Community & Social scores and a 4th percentile ESGControversies score (very bad).

The blame has gradually shifted from Post Office Ltd to Fujitsu over the past month in social media, and Fujitsu's ESG scores have dropped substantially - see graphic below.

February 19, 2024

Top Robotic Initiatives Companies

In our earlier post we identified #Robotics as the industry with the most positive media sentiment in 2023 (and 2022).Attached is a list of the companies most associated with Robotic initiatives or products in the past two months. Based on our #quant research, the valuations of such companies tend to (on average) outperform when associated with higher media sentiment (as they have been).

January 02, 2024

Positive Industries in 2023

Every year we look at the most positively viewed industries in global #businessnews and #socialmedia.For 2023 we see #Robotics on top (as it was in 2022) followed by #RenewableEnergy, #Tourism, #Fintech, and #Infrastructure.Further down the list the industries with a country code after them indicate the industry is primarily favored in one region (US = United States, CN = China).The stock prices of the highest #sentiment companies and industries on average outperform over the following year.In 2022 AI was #2 but fell to #33 based on legal and social challenges.We wish you all a happy, healthy, and prosperous 2024! #happynewyear

January 01, 2024

2023

Bitcoin Momentum

#Bitcoin sentiment has been at highs and the bull keeps running - a phenomenon we call sentiment momentum. In this paper https://lnkd.in/gasgp9BQ we show that across thousands of global stocks, sentiment precedes price momentum (using Granger Causality Analysis), and the chart below illlustrates that effect in #BTC.In the chart, the black price bars are BTC/USD and the smooth lines are two moving averages of #sentiment (30 day and 90 day superimposed). The red shading indicates negative sentiment pressure (the 30-day sentiment is lower than 90-day), and blue shading indicates more positive sentiment.Social sentiment on BTC is the highest since 2020, and news sentiment is the highest since 2018. When sentiment falls substantially, we're likely to see a price correction, but that isn't happening yet.

December 11, 2023

Weight Loss Drugs Sentiment

#Antidiabetes drugs (#glp1 agonists) have been in the news not only for success in treating diabetes, but also for the shortages caused by off-label uses for #weightloss, #addictivedisorders, and #longetivity.#MorganStanley sees the drugs decreasing food industry profits and dramatically impacting stock prices, with an 80% gap emerging since Jan 2023 between stocks of companies benefiting from these medicines (largely #pharma) vs those being impacted by these medicines (retail and fast food companies). Here is a #foodindustry perspective: https://lnkd.in/g5smxCGj. Big picture, these medicines may substantially reshape US society.We get a lot of questions about which of these medicines is winning in the public sentiment space, and our analysis shows #Zepbound (daily green line below) with higher media sentiment than #Ozempic (blue line below). Zepbound was the last GLP1 medicine to be released, about 10 days ago. We'll post more as the situation evolves...

November 28, 2023

Investment Opportunities using Emotions paper

This recent academic paper - Investment Opportunities Offered by Investor Emotions - (https://lnkd.in/gTg4F9qu) implements a practical portfolio construction strategy built on existing research that identify investor emotions as precipitative of post-earnings excess returns.Even accounting for steep transaction costs, the authors demonstrate a long-short strategy yielding an 18% annualized return that has low or insignificant correlations to all FF5 factors using #Refinitiv #MarketPsych data.

October 20, 2023

Portfolio Allocation using RMA

A recent paper in the #JournalofFinance investigates how investors approach their portfolio allocation. The authors find evidence for an investor heuristic called naive buying diversification (NBD), where investors allocate 1/N of their money in the N assets bought on that day (instead of considering their portfolio composition as a whole). The authors used our MarketPsych Analytics ("TRMI" in the paper) to test an explanatory hypothesis for such behavior. Their analysis provides support for a stock-picking explanation: NBD is more common when investors buy similar stocks, such as stocks with similar buzz (amount of media chatter). The findings could "have implications for the design of contribution-based saving plans, such as pension schemes". https://lnkd.in/da7m7BSdThe researchers combined datasets of #Barclays brokerage transactions (and demographic data), LSEG (London Stock Exchange Group) price data, and #MarketPsych news data.The below plot shows the function by which investors are more biased to invest in the similar buzz stocks. Lower buzz difference between two stocks (one proxy for similarity) is correlated with higher likelihood of them being purchased using the NBD pattern.

October 13, 2023

China Residential Property

#China's 3rd largest residential real estate developer #CountryGardenHoldings Co Ltd defaulted on its bonds this month. Note that our #Gloom score for the company was already triggering well in advance (image attached).The past two weeks distress in the Chinese financial system are creating a #RiskOff attitude in global markets.Per #Reuters: "China's property sector ... is the largest asset class in the world, with an estimated market value of around $62 trillion... The next thing to watch is how regional governments, many of which rely on real estate revenue, manage their debt."On top of commercial (and multifamily) real estate distress in the US, we may see a #HardLanding from #MonetaryTightening after all. (Markets have been betting on a soft landing until this week).

August 23, 2023

AI Trading: What Could Possibly Go Wrong...

The popular press is abuzz with articles about AI's transformation of investing, financial research and analysis, and stock market forecasting. At MarketPsych we work in the field of AI with large language models (LLMs) including chatGPT, and in today’s newsletter we explain some LLM trading basics as well as our own successful AI agent designed for stock price forecasting. To illustrate the value of AI in investing, we'll start with the human weaknesses it is designed to exploit…

Investing on fear

AI vs AGI

chatGPT is a non-sentient model (it's not conscious), and there is a big gap between it and the type of artificial general intelligence (AGI) described in the Fear Index. As physicist David Deutsch noted: “AI [artificial intelligence] has nothing to do with AGI [artificial general intelligence]. It’s a completely different technology, and it is in many ways the opposite of AGI … An AGI can do anything, whereas an AI can only do the narrow thing that it’s supposed to do.”

July 16, 2023

Russia's regime change score: minute-to-minute

Below is a minutely depiction of our #RegimeChange score (blue line) for #Russia from June 22nd to 28th, 2023 UTC time.MarketPsych's real-time NLP engine scours macroeconomic themes, political risk, and country-level signals around 100' of risk-related events from 1000s of #globalnews and #socialmedia sources in 13 languages. In partnership with Refinitiv, an LSEG business our clients set risk management alerts for 100s of such risk-related events. Available country-level indicators include #SocialUnrest, Terrorism, InflationForecast, BondStress, and 100+ more.

June 28, 2023

Stock-forecasting AI model shows impressive performance

In Jan 2020 our MarketPsych team launched a stock predictive model in partnership with #StarMine and Refinitiv, an LSEG business, called the MarketPsych Media Sentiment (MMS) model. It is an #AI based model, making stock forecasts based solely on media themes and #sentimentanalysis.The model was approved for production in Aug 2019 (red dotted line in the image) and has been sold commercially since Jan 2020. It showed yet another great performance in May 2023.

This model ranks stocks daily according to their expected relative performance for the following 30 days. This past May, the spread between the highest and lowest-ranked US stocks was 4.3%, accruing to +13.4% on a 12-trailing months basis. Among large-caps, the performance is at an impressive +22% with a Sharpe of 3.3. The decile spread is plotted in the image as the blue line.There are predictive patterns embedded in the emotions and themes expressed about companies in news and social media. #behavioralfinance #quantitativefinance #quantitativeanalysisFor an introduction to MMS, please watch the promo video at: https://lnkd.in/gNqwX7fx

June 21, 2023

U.S. commercial real estate sentiment plummeting - time to buy?

With U.S. commercial real estate sentiment plummeting, is it time to buy?In the chart below we plotted the #Russell1000 price versus two moving averages of media-derived U.S. #commercialrealestate sentiment from 2020 to now. When the 90-day is under the 200-day, the gap between the lines is shaded pink. Note that COVID led to a slight downturn due to WFH (work from home), then there was optimism about RTO (return to office), but today's interest rate / hybrid work habits-driven collapse depressed sentiment much more.The Wall Street Journal last week reported distressed asset buyers buying properties like #AgaveHoldings. Per managing director Jose Perez “We have learned from the past, that when everyone is selling, buy; and when everyone is buying, sell.” https://lnkd.in/gpqKujd9#sentimentanalysis #sentiment #behavioralfinance

May 20, 2023

US Inflation to Drop to 4.3% Next Month: Insights from CPI and Predictive Model

The U.S. CPI came out yesterday showing inflation at 4.9%. Our predictive model, based on the aggregate inflation forecasts from news and social media, shows a further significant inflation drop over the next month to 4.3%. This model has consistently had a 30% tighter fit to the U.S. CPI than the consensus of experts since it began rolling-forward (expanding window architecture) in 2004.Once interest rate expectations plateau, then the market may resume its upwards drift.

May 11, 2023

Schwab Bucks Trend in Latest Bankrun as Non-US Banks Take a Hit

Today's bankrun is targeting large non-US banks: Credit Suisse (a repeat target from back in October 2022) and BNP. Note that Schwab is in the green, probably due to being in the US (Fed backstop) and having a supportive CEO aggressively buying his own shares.

We plotted the overnight bullishness in the media about select major banks, below:

March 15, 2023

Media Mentions over SVB: Other Regional Banks and Tech Companies Take Center Stage

These are the companies most frequently mentioned in the media along with SVB in the last 5 days. Many are large financial institutions (LFIs, gray bars) that were mentioned due to stock prices falling across the board. However, the main concern surrounding SVB is other regional banks (blue bars), such as First Republic, Signature Bank, and Pac West Bancorp.

Several technology companies have also been frequently mentioned due to their possible exposure to SVB (red bars): Roku, Circle, Roblox, BlockFi, Coinbase, and Etsy

.

March 12, 2023

Sometimes News Sentiment Drives the Market, Sometimes It is Only Reacting

According to a new paper, news sentiment sometimes drives the stock market, and sometimes reacts to it. Specifically, news drives market prices during periods of upheaval (debt crises, Brexit and Covid-19 to name a few). Sentiment reports on market action - after the fact - during less volatile times.

Spillover between investor sentiment and volatility: The role of social media by Ni Yang (Auckland University of Technology), Adrian Fernandez-Perez (Auckland University of Technology) and Ivan Indriawan (University of Adelaide)

March 03, 2023

Risk Signals for Norfolk Southern's Train Derailment

Following on #Adani, another example of real-time #AI-detected ESG controversies monitoring capturing events as they evolve. Note how the controversies score decline leads the share price lower.

We send our sympathies to the residents of East Palestine, OH.

February 28, 2023

Adani: AI Detects Investment Risk Faster Than Humans

After Hindenburg Research released their report highlighting AdaniGroup's accounting misdeeds, our ESG scores immediately signaled danger, yet the stock hovered for a day as investors entered a state of denial (see the quotes from representative social posts below).

In the chart below several Adani long-term ESG Controversy scores are plotted against the share price of Adani Total Gas (the biggest hit).

Our 365-day average ESG Controversies scores fell for all Adani companies, and Adani’s share prices started to plummet the day after. (Our 60-second scores were even faster...)

February 27, 2023

Americanas SA One-day Decline, the Largest in Recent Memory in the Ibovespa

The CEO and CFO of Americanas SA resigned on Jan 11th due to Accounting inconsistencies at the company.The stock posted the largest one-day decline of any of the 89 companies currently in the Ibovespa index in at least 20 years. AI-based ESG analytics picked up the drama as it happened.Hiring new CEO Sergio Rial (formerly CEO of Santander Brazil) on August 20, 2022 was a good public relations move for Americanas.The company’s ESG Management score (our real-time ESG metric, green line) jumped after the announcement in the chart below (stock price is blue bars).Then on Jan 11th, 2023 (shortly after assuming his new job on Jan 1st) he reported accounting irregularities, causing both the drop in our Management score (in the final days of the chart) and the departure of the new CEO.

January 19, 2023

Top 4 US industries in 2022 News and Social Media Sentiment

We reviewed public sentiment about 40 US industries over the past year, and our data shows the most overall excitement about the top 4 below (top 10%), in descending order:

January 15, 2023

2022

Argentina's World Cup Win Shows How Major Sports Victories Impact the Local Stock Market

Note the spike higher in Argentina’s Stock Market the Merval following their historic World Cup victory last weekend.

This is similar to academic research such as “Sports Sentiment and Stock Returns” published in the Journal of Finance by Alex Edmans, Diego Garcia, Øyvind Norli - losses dampen moods and victories lift them - leading to national economic effects...

December 22, 2022

Optimism in China after Covid-Zero Policy Rollback

Note how optimism about the Chinese Stock Market rocketed following rumors (and then reality) of Covid Zero policy roll back.

Behavioral finance research shows that relief from financial fear leads to - unexpectedly - excessive risk-taking, accounting for this “COVID relief rally.”

The optimism chart was developed using a z-score of our Chinese stock market optimism index, derived from millions of news and social media comments in 13 languages, over the course of 2022.

December 16, 2022

UK Leadership Media-based Perception

Our Leadership score for the UK tracks news and social media-based perceptions of British leadership quality over time using NLP and Fall 2022 is a rollercoaster (see chart).

Most recently, the increasing cost of living is impacting Leadership perceptions.

December 13, 2022

The Economy Grows, Recession in Sight

While the economy seems to still be growing, our media-based recession indicator says it will soon be in recession.

Note that when the media begins to beat the drum on an impending recession, a self-fulfilling prophecy may kick in as businesses hunker down in anticipation of the event. In this chart we show in blue the net references to "economic growth" vs "economic contraction".

When the references to Growth vs Contraction fall below 1 standard deviation of their historical average, this has always preceded an actual recession since at least 1968 in the U.S.

November 13, 2022

Media Data as Predictor of Real Estate Prices

A depiction of U.S. real estate sentiment since Jan 2019.

The blue bars are the Russell 1000 stock index. The purple line is average commercial real estate sentiment, which is higher now that workers are going back to the office post-COVID. The green line is residential real estate sentiment, which is as low as it has been since 2011 due to rising mortgage rates.

Sentiment is measured in the U.S. business news and social media from references to each asset class.

November 09, 2022

The Acceleration of Everything

“We are not makers of history. We are made by history.”

~ Martin Luther King, Jr.

2021 was the Great Acceleration of technology and society: Memes, Anti-aging, mRNA, CRISPR, AI, Sustainable Finance, the Electricity Economy, Metaverse, DeFi, NFTs, Flying cars, and to cap it all off – surprise! – inflation.

As investors it helps to know the dominant narratives driving the market, and where we are in each cycle. In 2021 media narratives dominated the conversation and passed on silently in COVID-like waves. The contagiousness of memes, and the bold meaninglessness of many, imbued 2021’s financial markets with a beautiful insanity.

An article summarizing a few of the year’s memetic winners is here. The pace of change will slow (some mini-bubbles are popping), but markets will be forever changed. It’s an amazing time to be alive, with the Acceleration of Everything.

January 16, 2022

2021

UFOs, the Unexplainable, and Solving Mysteries with Data

For generations, U.F.O.s have been in the purview of late-night call-in radio shows and supermarket tabloids, not the Department of Defense. Now the government is publicly acknowledging that mysterious sightings can no longer be dismissed, and a major report is due in June.

~ “Are U.F.O.s a National-Security Threat?” April 30, 2021. David Remnick. The New Yorker Radio Hour.

In December 1998, on a dark snowy road in southern Sweden, I glanced above the trees and saw a small glowing oval object moving in parallel to our car. The road was straight, the sky was cloudy and black.

I pointed it out to my girlfriend, who was driving. We stared at it silently for about 10 seconds. The object moved in front of the car, hovering over the road a few hundred meters ahead. It maneuvered in perfectly straight lines – vertical then horizontal, far then near, side to side. I looked around for an explanation – was it a reflected dashboard light, a helicopter?

After a minute of silence I reluctantly asked, “Are you seeing this? What is it?”

She nodded but stayed silent.

I offered, “Is that what they call ... um ... a UFO?”

She peered at it thoughtfully, shrugged, “Mmmm, yeah, I guess so ...”

After another minute of hovering and a few perfectly straight sideways and vertical movements, and it darted away. I filed it under "Head Scratchers."

June 04, 2021

Being Greedy, Doing Good - The New Economics

As a young investor in the late 1990's the conventional wisdom was that "sin stocks" (gambling, alcohol, and weapons stocks) outperformed others. Investors could choose to either be greedy and profit or be principled and underperform. The narrative fit the transactional "greed is good" nature of the times. But it turns out the story isn't so simple.

Inflation spotting, meme stocks (see our Jan newsletter), cryptocurrencies, and the green transformation – lots happening in markets. Today we focus on the latter.

With a our new ESG dataset, we see that the performance of ESG investments is more often the opposite of the conventional wisdom - invesors can both do good AND outperform.

BALI

March 12, 2021

The Revolution Will Be Game-ified

This week's GameStop battle was the latest in a smoldering revolution - a revolution embodied in a cute Shiba Inu (and a few rainbow ponies).

Dogecoin. wow

Dogecoin is a cryptocurrency started as a joke, and it is worth $6.7 billion (as of Jan 29, 2021).

Dogecoin is a meme that resonates widely perhaps because it has no “fundamental” value. It’s human - or canine - whatever. The point is, it isn’t useful. It has no tangible value, yet it has grown to a market cap of $6.7 billion.

January 30, 2021

2020

Election Psychology & Markets

“Prepare for the unknown by studying how others in the past have coped with the unforeseeable and the unpredictable.”

~ George S. Patton

The chart above displays the S&P 500 average versus the level of media uncertainty around past (and present) U.S. presidential elections. The yellow line is the average news and social media uncertainty level. The uncertainty average includes all presidential elections back to 2000. The white dashed line is the average S&P 500 return around all presidential elections since 1928. In the longer lower plot, the red line shows our 2020 level of U.S. uncertainty coming into the Trump-Biden match-up.

In 2020, uncertainty is higher than any other election. The “uncertainty collapse” (decline in the yellow line) starting 2-3 weeks before the elections (1) correlates with a rally in the S&P 500 and (2) happens when the media (and others) believe they know the likely outcome.

October 21, 2020

Elites and Inequality

WILL THE ELITES ACCOMMODATE?

“Inclusive economic and political institutions do not emerge by themselves. They are often the outcome of significant conflict between elites resisting economic growth and political change and those wishing to limit the economic and political power of existing elites.”

― Daron Acemoğlu, Why Nations Fail: The Origins of Power, Prosperity, and Poverty

After the global financial crisis, many people lost trust in the financial system. The Fed came to the rescue, and market prices recovered. Yet the sense of economic unfairness remained. Rising asset prices helped those with assets, while wages stagnated.

June 05, 2020

Unraveling Social Trust & the Path Forward

“And with economic and cultural indexes down, with the world turned darker and more predatory, we will go through more. We thought we’d be telling our grandchildren about the spring of 2020. Actually we’ll be telling them about the coming 10 years, and how we tried to turn everything around.”

~ Peggy Noonan, "On Some Things, Americans Can Agree". June 4, 2020. Wall Street Journal.

Last week my 11-year old daughter cried as she told our family how young neighborhood boys her age - strangers - had attacked her. They pelted her with batteries and tried to drive her off the bike path as she pedaled away from school, ramming her bike with their own.

Her mother and I explained that maybe the boys’ home lives aren’t positive. Maybe they are being raised in abusive households. But that didn’t satisfy her sense of injustice.

Her school is in an immigrant neighborhood of Amsterdam, near public housing. Here in the Netherlands there is a higher proportion of Surinamese immigrants in public housing. These are largely descendants of African slaves from Dutch Suriname. Racial issues were in the back of our minds.

June 05, 2020

Coronavirus & the Information Cycle in Markets

It's not easy training children to say "please" and "thank you" when appropriate (I must have reminded mine 10,000 times), and one unexpected benefit of the coronavirus pandemic is that my children now have a healthy hand-washing habit. Nothing focuses the mind like contagious disease.

Today's newsletter focuses on information contagion - how information infects markets, provokes denial and fear, and creates investable patterns during negative events like disease outbreaks. A PDF presentation with graphics and more information underlying the newsletter is available here.

For excellent alternative perspectives, see This New York times review projecting the disease burden of the pandemic. This James Mackintosh article in the Wall Street Journal discusses financial markets scenarios (e.g., L-U-or V-shaped bottom).

No one can deny the epidemic anymore - it's time to wash our hands and dig in.

UNDERREACTION (a.k.a. DENIAL)

I've given webinars and conference presentations on coronavirus over the past month (here's one), and I've been surprised by the wide range of attitudes towards the pandemic in different countries. As recently as last Friday I was on full flights in Scandinavia and occasionally shaking hands during meetings (and then nervously stuffing my hand in my pockets so I wouldn't touch my face).

However, at some banks in Stockholm meetings were canceled to prevent outsiders from bringing the virus into the firms. In other firms, in order to keep trading operations normal through the pandemic, employees were sorted into Team A and Team B alternating weekly home/work shifts. The general consensus in my meetings was that EU and US governments weren't taking the epidemic seriously enough. They were in DENIAL. As they say...

“Denial ain’t just a river in Egypt.”

~ Provenance unclear, but formalized by self-help guru Stuart Smalley (played by Al Franken), 1991.

March 13, 2020

Epidemics of Fear - The Cycle of Panicked Overreaction and Bounce

Eleven years ago we were trading through the Swine Flu epidemic. At the time, while I was trading our hedge fund (MarketPsy Long-Short Fund LP), my colleague Frank Murtha penned this humorous advice to relax about the outbreak (perhaps directed at me!)

Our fund's strategy took advantage of fear-driven dislocations, and we created the below image of an actual trade for our investors to understand how the fund timed investor overreaction. (In 2009 trading on social media was seen as seriously goofy, to put it politely, and we needed clear explanations of how our quant systems identified good trades).

February 04, 2020

2019

Emotional Manipulation in Markets

“All the incentives point to continuing this sort of self-extraction….Why would we stop scooping the attention out of ourselves, destroying democracy, and debasing our mental health when that’s the thing that makes the most money and Wall Street’s not going to stop funding it?”

Tristan Harris. Sep 19, 2019. “Fighting Skynet and Firewalling Attention.” Tim Ferris podcast, Minute 1:11.

"... I see people I have known my whole life slip away from me on social media, reposting conspiracies from sources I have never heard of, some sort of internet undercurrent pulling whole families apart, as if we never really knew each other, as if the algorithms know more about us than we do, as if we are becoming subsets of our own data, which is rearranging our relations and identities with its own logic, or in the cause of someone else's interests we can't even see ..."

Peter Pomerantsev. (2019). "This is Not Propaganda: Adventures in the War Against Reality."

“In the Banda Islands, ten pounds of nutmeg cost less than one English penny. In London, that same spice sold for more than £2.10s. – a mark-up of a staggering 60,000 per cent. A small sackful was enough to set a man up for life, buying him a gabled dwelling in Holborn and a servant to attend to his needs”

― Giles Milton, Nathaniel's Nutmeg: How One Man's Courage Changed the Course of History

"You need to build a fairytale that will be common to all of them.... The disparate groups needed to be unified around a central emotion, a feeling powerful enough to unite them yet vague enough mean anything to anyone."

Peter Pomerantsev. (2019). "This is Not Propaganda: Adventures in the War Against Reality"

December 08, 2019

Behavioral Manipulation & Tech - the Reckoning

“Facebook has learned how to manipulate empathy and attachment in order to increase engagement and make billions.”

~ Jennifer Szalai. Jan. 16, 2019. New York Times. "O.K., Google: How Much Money Have I Made for You Today?"

“Instead of mining the natural landscape, surveillance capitalists extract their raw material from human experience.”

~ Jennifer Szalai. Jan. 16, 2019. New York Times. "O.K., Google: How Much Money Have I Made for You Today?"

“You’re not technically the product, she explains over the course of several hundred tense pages, because you’re something even more degrading: an input for the real product, predictions about your future sold to the highest bidder so that this future can be altered.”

~ Sam Biddle. Feb 2, 2019. “A Fundamentally Illegitimate Choice”: Shoshana Zuboff On The Age Of Surveillance Capitalism." The Intercept.

April 11, 2019

2018

Stock Market Rout, Playing the Emotional Game, & Sentiment Feedback Loops

True story: In the first few days of October 2018 my friend Nate asked me over coffee, “Do you think we’re at the top of the market?” Over the course of an hour Nate and I went through the market prognosis in detail. Interest rates were up, housing prices falling, increasing economic uncertainty, and our sentiment indicators were all negative. We both agreed it was the top. We closed our conversation with a mutual reminder - “Time to sell everything.” A few days later the S&P 500 dropped more than 3%, beginning the rout that continues through this week.

But to be clear - I'm no hero. I didn't sell anything.

And I’m not alone in my inertia. Despite what we KNOW to be true intellectually, taking action based on that knowledge is a different beast.

Today’s newsletter examines why it’s difficult for many people to sell at tops and why - based on longer term patterns - the selling may not be over.

IT'S NOT AN INTELLECTUAL GAME

I have various excuses for my inaction in early October - I’m not a market timer, I'm not currently managing money for others, it's not worth my time and attention, etc... All seemed true at the time, yet all these excuses are intellectualizations. I could have saved a pretty paper penny getting out back then. The leap from armchair investor to professional crosses that motivational chasm.

December 21, 2018

Sentiment, the "Big One", and Bali

A few months ago my wife and I moved our kids from California to Bali, Indonesia for the year. We've been surprised by the strength and frequency of the recent earthquakes. During one earthquake I watched waves of water slosh out of our pool. During another I paused a business call as my roof groaned and light fixtures jangled. During a few late night earthquakes I’ve been shaken awake in a daze wondering, “Why is my wife jumping on the bed so hard?” Is she doing jumping jacks?!" (She had similarly foggy and illogical thoughts about me).

We have chosen to live in the “Ring of Fire” where earthquakes and volcanic activity are a fact of life – part of what makes the landscape beautiful, lush, and dramatic. And despite the instability here, we feel very lucky – residents of the Indonesian islands Lombok and Sulawesi have lost much more than pool water.

Financial markets have their own quakes and tremors, including one this week. Intellectually, we know such events will happen. But after each many people wonder “Could this be the Big One?” As a seismologist of the human psyche, in today's newsletter I feel some responsibility to explain what we know about predicting market downturns. Today’s newsletter explores market quakes: their psychological predictors, the potential this week's tremor was a precursor to the “Big One”, and a Balinese understanding of duality.

Sentiment Momentum

October 14, 2018

Profiting from Media Outrage

Don't trade angry. Seriously. If you're considering an investing decision and you find yourself feeling angry, stop, walk away, and go do something less destructive, like headbutt your bathroom wall or drop a cast iron skillet on your foot.*

~ Frank Murtha, PhD from The Seven Deadly Sins of Investing: Anger.

The popular TV show "Billions" follows the conflict between powerful U.S. attorney Chuck Rhoades and hedge fund manager Bobby Axelrod. Chuck's wife Wendy Rhoades is a psychiatrist and the performance coach for Axelrod's hedge fund, Axe Capital. In the premiere of season 3, Axelrod's professional and personal lives are threatened by rage-fueled misjudgments. During a coaching session, Rhoades performs an exercise to help him transform his anger.

Axelrod (A) notes that the seeds of his anger were planted when he - a poor kid - was bullied by rich kids:

A: "That rage grew in me. Worked like jet fuel for years." ...

R: "It was useful."

A: "Yeah it was, got me here."

R: "We can agree your rage worked for a time. I think your brain, instincts, market feel, all that had more to do with it. But for the moment let's agree that the rage worked for a time. But let's look for a moment when it was the wrong tool, and it cost you more than it made you. And about how when you allow your anger to make you blind to consequences it shuts off those more crucial skills." [my bold]

As Dr. Rhoades alluded, anger distorts judgment. Anger is a unique emotion in that it increases both risk aversion and confidence. Irate investors are less willing to invest in a socially scorned company, they feel more certain that their decision to avoid them is sound, and they hold on to these risk averse feelings even after the company has taken action to remedy the situation. As the Buddha noted, "We are not punished for our anger. We are punished by our anger." Sometimes the anger is projected onto a target, like a company, and we miss opportunities due to our anger-distorted judgment.

In today's newsletter we demonstrate powerful evidence that the stocks of companies described with anger in the media outperform their peers substantially over the following year. When a company runs afoul of the social consensus - BP due to the Gulf of Mexico oil spill, Facebook due to privacy concerns, VW due to falsifying pollution tests - investors have an opportunity.

The media demonstrates a frequently shifting spotlight of moral outrage. The phenomenon was captured in this Slate article detailing the daily social and media outrage explosions of 2014. Such social scorn often lands on publicly traded companies, hitting their stock prices. Because of the cognitive distortions associated with anger, causing investors to become risk averse, these media pile-ons provide a historically consistent and significant opportunity.

The below equity curve is one of our new quant results from our new Thomson Reuters MarketPsych Indices version 3.0 data set in the talented hands of our Head of Research CJ Liu and Alice Fu.

May 20, 2018

The Rise, Fall, & Resurrection(?) of Cryptocurrencies

The universe of numbers that represents the global economy. Millions of hands at work, billions of minds. A vast network, screaming with life. An organism. A natural organism. My hypothesis: Within the stock market, there is a pattern as well... Right in front of me... hiding behind the numbers. Always has been.

~ Max Cohen in Pi (1998, movie), Artisan Entertainment.

Restate my assumptions: One, Mathematics is the language of nature. Two, Everything around us can be represented and understood through numbers. Three: If you graph the numbers of any system, patterns emerge. Therefore, there are patterns everywhere in nature. Evidence: The cycling of disease epidemics;the wax and wane of caribou populations; sun spot cycles; the rise and fall of the Nile. So, what about the stock market?

~ Max Cohen in Pi (1998, movie), Artisan Entertainment.

My new Hypothesis: If we're built from Spirals while living in a giant Spiral, then is it possible that everything we put our hands to is infused with the Spiral?

~ Max Cohen in Pi (1998, movie), Artisan Entertainment.

“When I was a little kid my mother told me not to stare into the sun, so once when I was six, I did. At first the brightness was overwhelming, but I had seen that before. I kept looking, forcing myself not to blink, and then the brightness began to dissolve. My pupils shrunk to pinholes and everything came into focus and for a moment I understood.”

~ Max Cohen in Pi (1998, movie), Artisan Entertainment.

April 06, 2018

2017

2017's Most Trusted Financial Firms, Most Loved Retailers, and Most Innovative Tech Companies

The social media herd can turn on a dime, praising a company one month and then trashing its reputation the next (see Papa John's, below). The past year has seen many such ups and downs, and this article looks at a few of those the herd ranked highest.

MarketPsych's patented natural language processing engine quantifies emotions and themes expressed in relation to a universe of over 12,000 global companies, 45 currencies, 187 countries, and 36 commodities. The software scans articles and posts in over 800 financial social media sources and 2,000 premium news sites. The Thomson Reuters MarketPsych Indices (TRMI) data feed results from this analysis. The TRMI is utilized by the world's top funds, banks, and government agencies for asset allocation and investment research.

Using the TRMI data, we performed a year-end analysis to ascertain the top global companies as described in financial social media. Of a pool of 12,000 global companies tracked, we ranked only those mentioned on average more than 10 times daily in social media. We then ranked and identified the Most Trusted financial firms, the Most Loved retailers (consumer cyclicals), and the Most Innovative technology companies.

While global real estate and infrastructure investment firm Brookfield Asset Management was surpassed this year as the largest global real estate investor, the company remained the most widely trusted and admired financial stock by investors commenting in social media.

December 28, 2017

Bitcoin, Cryptocurrency, and the Greatest Bubble in History

"The prospects for Bitcoin are bright"

~ MarketPsych's April 1, 2013 Newsletter

"Their conversion value to national currencies depends entirely on supply, demand, security, confidence, and the whims of the investing crowd and businesses who accept them."

~ MarketPsych's April 1, 2013 newsletter

"Keep in mind that most people feel inertia ... we often wait to make the obvious investment after it has been proven valuable (and we are too late in entering)."

~ MarketPsych's April 1, 2013 newsletter

"Ultimately, cryptocurrencies are just digital assets native to a specific blockchain"

~ Josh Nussbaum. Oct 16, 2017. "Mapping the blockchain project ecosystem." Techcrunch.

December 03, 2017

The Last Supper, Sentiment Cycles, and Human Skulls

One of you shall betray me.

~ Jesus, speaking to his disciples the night before his arrest.

Human subtlety...will never devise an invention more beautiful, more simple or more direct than does nature, because in her inventions nothing is lacking, and nothing is superfluous.

~ Richter II, The Notebooks of Leonardo Da Vinci, Vol. 2. p. 126 no. 837.

I have been impressed with the urgency of doing. Knowing is not enough; we must apply. Being willing is not enough; we must do.

~ Leonardo da Vinci

First, never underestimate the power of inertia. Second, that power can be harnessed.

~ Richard Thaler & Cass Sunstein. 2008. Nudge: Improving Decisions About Health, Wealth, and Happiness.

October 16, 2017

The Dawn of Social Prediction

"Economists pride themselves on being the most scientific of social scientists. This leads them to reduce all human motives and behavior to quantifiable variables such as utility, welfare and income. But people are not by nature quantitative, and their motives often have no economic basis. Today’s most divisive issues, from fairness and inequality to national identity and culture, don’t have economic solutions."

~ Greg Ip. August 26, 2017. "In Defense of the Dismal Science." Wall Street Journal.

"The American company that promoted the Internet hardest in its early days, Sun Microsystems, conducted research in 1997 into how people read on the Web and concluded simply, 'They don't.' They scan, sampling words and phrases. Why? In part because any one page, on which the fluttering user happens to have lighted momentarily, competes for attention with millions more."

~ James Gleick. 1999. Faster: The Acceleration of Just About Everything. Vintage. p.87.

"In the same way that computers have operating systems at their core — dictating the way a computer works and serving as a foundation upon which all applications are built — everything in life has an operating system (OS). It is at the OS level that we most frequently experience a quantum leap in progress."

~ Bryan Johnson - Founder, Braintree and the OS Fund

"Much of the human experience (knowledge, disease) spreads by proximity, and for any one person the number of elbows in proximity has exploded. In past times, even in the most crowded city, we lived close enough to only a few people to, say, read their journals or track the temperature of their hot tubs. Now, in hordes, they put that information on-line. The multiplication of information pathways leads to positive feedback effects in the nature of frenzies."

~ James Gleick. 1999. Faster: The Acceleration of Just About Everything. Vintage. p.86.

August 26, 2017

The Story-telling Cycle in Markets

Almost 99 percent you realize is just stories in our minds. This is also true of history. Most people, they just get overwhelmed by the religious stories, by the nationalist stories, by the economic stories of the day, and they take these stories to be the reality.

~ Yuval Hariri, Historian and author of the books "Sapiens" and "Homo Deus"

Money is probably the most successful story ever told. It has no objective value. It's not like a banana or a coconut. If you take a dollar bill and look at it, you can't eat it. You can't drink it. You can't wear it. It's absolutely worthless. We think it's worth something because we believe a story. We have these master storytellers of our society, our shamans — they are the bankers and the financiers and the chairperson of the Federal Reserve, and they come to us with this amazing story that, "You see this green piece of paper? We tell you that it is worth one banana."

~ Yuval Hariri

“It’s a motivated decision to say ‘no’ to learning available but unwanted information .... People avoid information if it’s going to make them feel or behave or think in a way they don’t want to”—especially any evidence that could jeopardize their belief in their competence and autonomy or could require taking difficult or prolonged action."

~ Jason Zweig citing Jennifer Howell, a psychologist at Ohio University, in his excellent column in the WSJ

On the first trading day of this year Valentijn van Nieuwenhuijzen’s laptop pops open. He sees right away that something special is going on. The MarketPsych Indices, the system by which NN Investment Partners [formerly ING] measure sentiment in the market, are coming in…words that are associated with stress and gloom course through digital media...

The main strategist of the Dutch asset manager, with € 187 billion under management, taps the brakes: he reduces investments in shares and raises more cash. Later that week the stress spreads: worldwide stock markets went down sharply...

~ Lenneke Arts & Jeroen Groot. February 28, 2016. “Beleggen met big data wordt langzaam gemeengoed.” Financial Daily. (Translated from the Dutch).

June 26, 2017

Switzerland, Neurofinance, and When to Sell in a Bull Market

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing."

~ Chuck Price (then CEO of Citigroup) to the Financial Times on July 9, 2007.

"The current level of the CAPE ratio 'would suggest reducing your holdings of stocks, especially for a long-term investor. We can't time the market accurately, but we know that when it's this high, over the long term, it usually doesn't do great.'"

~ Robert Shiller quoted in CNBC, February 24, 2017

"Merchant: In this chaos of opinions, which one is the most prudent?

Shareholder: To go in the direction of the waves and not to fight against the currents."

~ Joseph De La Vega. 1688. "Confusion de las Confusiones." (The first book about the operations of a stock market, the Amsterdam Exchange).

April 02, 2017

Is Trump Playing Crazy? Negotiation, the Game of Chicken, & Dollar Sentiment

To achieve their mating goals, male elephants will sometimes play games of chicken, with one individual essentially giving the impression that he is crazy and has become an irrational player in a game premised on shared rationality and predictability.

~ Professor David Barash, Op-Ed in the NYTimes, 2011

Fittingly, this Year of the Rooster corresponds with a surge in a cock-inspired game in international negotiations: playing chicken.

As a young man I occasionally stood on the bridges across the Rio Grande, practicing Spanish and watching Mexicans commute to work in the United States. They bagged their clothes, paid a peso or two to a man with an inner tube, and were gently pulled across the river under the eye of inert border patrol agents. U.S. customs wasn't apparently concerned enough to intervene. I myself climbed under the fence or waded the river a few times out of convenience or curiosity. Even the Laredo, Texas INS chief's nanny was well-known to commute to work that way. In subsequent years the border has obviously tightened. And now we're hearing about The Wall, whose conception has badly punished the Mexican Peso and local stocks.

As active investors it is our job to predict trends and reactions in global economies and markets. Donald Trump's spontaneity has introduced a degree of unpredictability to our work. His negotiations around trade agreements, immigration policy, tax policy, military arrangements (NATO), and budgetary allocations are all going to be significant to the markets over the next year. Whether one agrees with Trump's proposals or not, it's important to know how he will pursue them, when he will go full force, and when he might back down.

Trump's tactics are familiar - and perhaps predictable - to students of game theory. Today's newsletter looks at this important topic - one we have addressed previously - the psychology of negotiation and playing chicken. Later we look at a turn in U.S. Dollar sentiment around the U.S. election and its aftermath.

Game Theory in the Real World

John Nash is the subject of the Academy Award-winning movie "A Beautiful Mind" and the father of Game Theory involving multiple equilibria in non-cooperative games - exactly what we need to understand the psychology of playing chicken.

In

It's a tactic that works surprisingly well, because male elephants can in fact become temporarily "crazy". One of the most terrifying sights in the animal world is an elephant in a state of must: Huge bulls, oozing a weird, foul-smelling, greenish glop from glands near their eyes, behave with violent abandon, taking risks and defying the basic rules of pachyderm propriety (and also giving rise to the term "rogue elephant"). Facing an elephant in must, other elephants — not to mention people — are well advised to get out of the way.

Dr. Barash explains that by playing chicken - as Donald Trump may be inclined to do as he renegotiates terms of existing trade agreements - low-power players can extract additional concessions due to their hardliner stance. As he puts it, "The trick to winning is for one player to convince the other that under no circumstance will he or she veer off course." Dr. Barash continues, "Another tactic, favored by the strategist Herman Kahn, is to "throw out the steering wheel," to demonstrate that you are locked into a certain path and can't swerve."

January 29, 2017

2016

The Seasons of Social Change, S&P 500 Sentiment Rebound, Perspective-shifting

As Brexit before it and the Italian referendum following it, November's U.S. election represents a social turning point. Some believe the light is fading across Western democracies. Others sense renewed engagement after a long period of public passivity. Both camps see this as a pivotal moment in history.

It's not only democratic engagement that's at a turning point. This time of year, across the northern latitudes, nature is growing quiet. Plants and animals have stored away food for the cold months and months of dormancy. When the snow comes, the quiet will be even deeper. During the darkness of winter, this week's solstice marks a turning point in the season. December's holidays symbolize the renewal of life, light, and growth from the depths of darkness.